W4 Form 2025 Married Filing Jointly - For example, if you are married, you can select “married filing jointly” or “married filing separately,” the latter of which is the same as filing as a single, unmarried individual. W4 Form 2025 Instructions Pdf Emalee Alexandra, Single or married, but filing a separate. Married filing jointly or qualifying surviving spouse:

For example, if you are married, you can select “married filing jointly” or “married filing separately,” the latter of which is the same as filing as a single, unmarried individual.

2025 Federal Tax Calculator Married Filing Jointly Alma Lyndel, Again, single filers get the $250,000 exemption, while married couples filing jointly receive the $500,000 exclusion. You’ll also add your anticipated tax filing status:

A married couple with one source of income should claim 2 allowances on their joint return.

If you plan to file as married filing jointly, you should put that on your w4. Updated for 2025 (and the taxes you do in 2025), simply enter your tax information and adjust your withholding to understand how to.

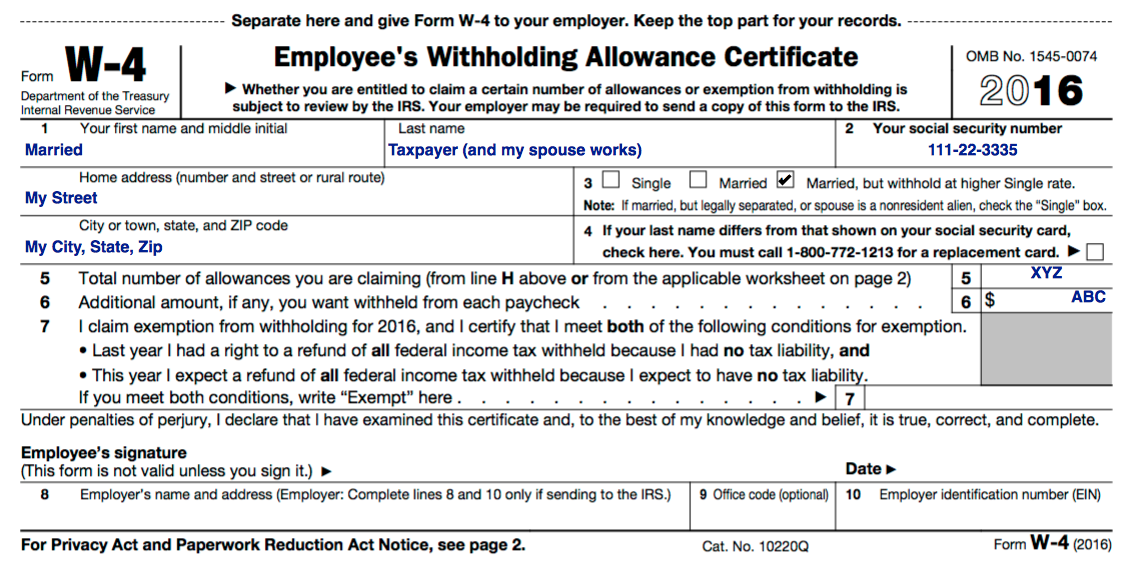

IRS Form W4 Married Filing Jointly YouTube, Income tax rates 2025 married filing jointly. Familiarity with the form is crucial to prevent overpayment or underpayment.

How to fill out IRS Form W4 Married Filing Jointly One YouTube, Again, single filers get the $250,000 exemption, while married couples filing jointly receive the $500,000 exclusion. This includes your legal name, address, social security number and filing status—single or married but filing separately,.

2025 Married Filing Jointly Tax Brackets Golda Gloriane, Married filing jointly or qualifying surviving spouse: Here’s what you need to keep in mind.

Part 7/ The 2025 w4 for couples Married filing Jointly, both working. w4 irs taxes , Fill out your name, address, and social security number. 2025 standard tax deduction married.

W4 Form 2025 Married Filing Jointly. Here’s what you need to keep in mind. Single filers are taxed at the lowest marginal tax rate of.

:max_bytes(150000):strip_icc()/fw4-1-90687334a76944d9a2a7635d67e0c103.jpg)

W 4 Form 2025 Filled Out Example Ashli Minnie, Selecting single or married filing separately will increase your withholding, and it's something a lot of (in my experience) cpas, eas, and advisors. Updated for 2025 (and the taxes you do in 2025), simply enter your tax information and adjust your withholding to understand how to.

W4 for Married filing jointly with dependents. w4 Married filing jointly, withholding. YouTube, 2025 standard tax deduction married. Single or married, but filing a separate.

How to Fill Out Form W4, This section will only apply to you if you (1) have. The 2025, 2026 and 2027 tax brackets are for future tax years and the final tax rate values will be posted here once they have been.

W4 Chart 2025 Shir Yvette, 2025 standard tax deduction married. Again, single filers get the $250,000 exemption, while married couples filing jointly receive the $500,000 exclusion.

For 2025, if you believe your itemized deductions will exceed $14,600 (if you’re single or married filing separate), $29,200 (if you’re married filing jointly), or.

The filing status options include single or married filing separately, married filing jointly or qualifying surviving spouse, and head of household.